Ever wondered why it is that the global financial system seems so short term and unsustainable when as citizens our interests are long term? Ever wondered what kind of people sit atop this huge pile of global money?

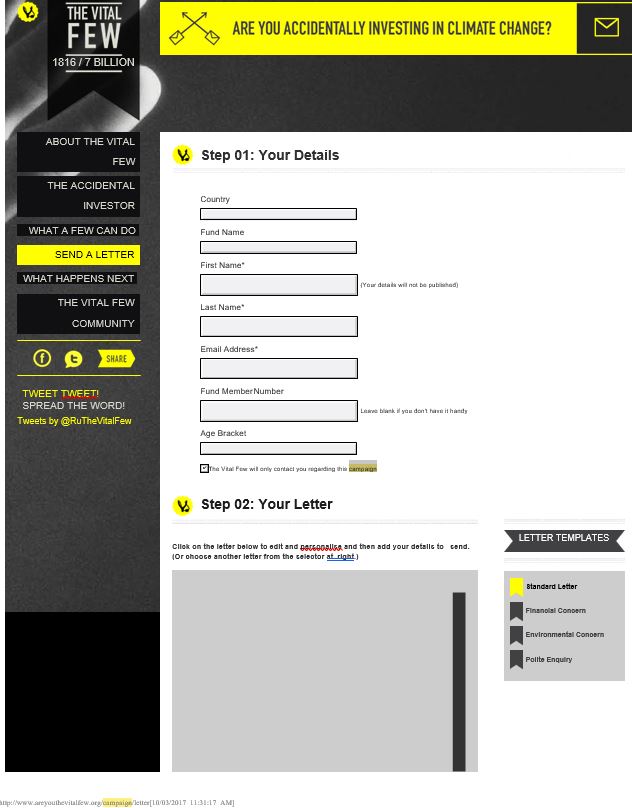

In 1995, global stockmarkets were owned mostly by governments and high net worth individuals. By 2010, over 50% (and rising) of global stockmarkets were owned by pension funds. Who owns those pension funds? YOU DO! The Vital Few are a community of people who are being inspired to speak up and take action to make the investments made on their behalf more sustainable. This is the new power of the ‘Citizen Investor’ Switched on to the evasive actions of the pension fund industry, The Vital Few are demanding disclosure and transparency on details about climate risk. They are determined to exercise their rights as pension members to ensure their future prosperity is secured – both financially and environmentally. The Vital Few know who they are and what they want more or less of in the future. They no longer choose to continue accidentally investing in anything that jeopardises that future. They want to make their choices and their money count. The Influence of The Vital Few, also known as the Pareto Principle, states that 80% of effects come from 20% of the causes. Which means a small group of purposeful individuals really can change the world…

“NEVER DOUBT THAT A SMALL GROUP OF THOUGHTFUL, COMMITTED CITIZENS CAN CHANGE THE WORLD; INDEED, IT’S THE ONLY THING THAT EVER HAS.” MARGARET MEAD